The impact of the USDA report on grain prices has not been as clear as expected.

Only in Chicago did wheat prices rise sharply by around 11 cents on Friday night after the release of the new USDA data. Hard wheat in Kansas and summer wheat in Minneapolis, on the other hand, were down as well as wheat prices in Europe.

At MATIF, wheat prices closed – after the rally of the last few days – with a slight minus of 1 euro at 187 euros per ton. The development of maize was also surprising for many observers: Despite a significantly smaller US harvest, corn prices in the country of U.S. fell sharply by 10 cents in current trade – mainly due to the unchanged very high corn yields and the sharply shrinking demand from the Feed and ethanol sectors.

In Europe, however, corn prices rose slightly by EUR 1 to EUR 177 for the early August date. European rapeseed went down by 2 euros to 382 euros per ton – the reason was apparently the soy prices, which dropped by around 10 cents per bushel.

Most analysts appear to consider the global supply of cereals to be appropriate and consider the demand for cereals in food and biofuels to be critical, as the corona epidemic has had a negative impact on this. “We are skeptical about whether we should hope for a highly sustained rally, but we also disagree with the bearish view that there is tons of wheat in the world,” said Tobin Gory, director of agricultural strategy at the Commonwealth Bank of Australia.

Wheat harvest smaller in Europe and the USA

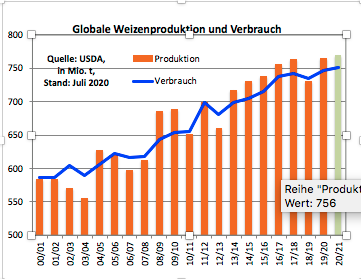

For wheat, the USDA has at least partially met the bullish expectations of analysts and farmers: The new forecast for 2020/21 assumes a somewhat smaller global harvest and smaller final stocks. But consumption and exports have also been reduced somewhat. The reason for the smaller global wheat production was the downward revised harvests in the European Union and the USA, as well as a slight correction in Russia.

The EU production (soft and hard wheat) has been reduced by 1.5 million tons to 139.5 million tons, mainly due to further great reductions for France. If the forecast is confirmed, this would one of the smallest EU wheat harvest since 2012/13. Exports shrink by 1.0 million tons to 27 million tons – compared to the record level of 38 million tons in the current season.

The harvest for Russia was only reduced by 0.5 million tons to 76.5 million because the lower winter wheat production volume is slightly offset by a higher summer wheat harvest. It would also be the second largest Russian wheat crop to date. Russian exports remain high at 36 million tons. World trade forecast for 2020/21 will be reduced by 0.8 million tons to 188.0 million tons, as lower EU exports are only partially offset by slightly higher Australian exports volume.

World consumption is also reduced by 1.6 million tons to 751.6 million, mainly due to the lower feed consumption in the EU and the USA. The forecast global ending stocks for 2020/21 will be reduced by 1.3 million tons to 314.8 million, but will remain at a record level, with China and India still accounting for more than half, 51 and 10 percent of the total stocks.

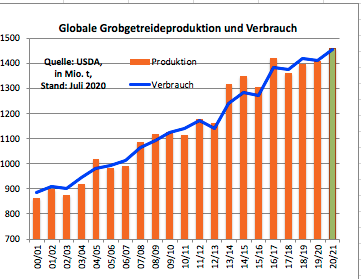

Smaller corn harvest in the US – but weak consumption

The outlook for the corn market in the US 2020/21 for this month provides for a significantly smaller supply – due to a significantly smaller harvest, lower consumption and lower final stocks. The corn used for ethanol was reduced again. For 2020/21, corn production in the USA is currently forecast to be 25 million tons lower to only 381 million tons, based on reduced sowing areas from the acreage report of June 30.

However, this significantly reduced harvest is still the second largest US corn harvest – and demand is apparently assessed as relatively weak. The yield estimate was not changed despite the current heat wave in the Midwest and is a very high 11.21 tons per hectare!! The seasonal average price for corn that producers are likely to receive was increased by 15 cents to $ 3.35 per bushel.

The outlook for the global corn market 2020/21 – with the exception of the USA – shows practically unchanged production, slightly higher trade and lower inventories compared to last month. The forecast larger corn harvest in Russia is offset by a decline in Canada. The barley production was lowered for the EU, however, increased for Canada.

For the current 2019/20 marketing year, corn exports for Argentina were increased, but somewhat reduced for Brazil, based on the data up to the beginning of July. China’s corn consumption for 2019/20 and 2020/21 has increased compared to last month based on an unexpectedly rapid increase in protein consumption for animal feed.

Global end-of-corn stocks for 2020/21 decreased compared to the previous month, with the largest declines after the USA – China, Argentina, the EU, Canada and Mexico.

Soybean: US harvest somewhat larger – high forecasts for Brazil

The supply and demand forecasts for the oilseed market for 2020/21 show a relatively stable production, somewhat lower exports, a higher crush and somewhat lower final stocks compared to last month. The rapeseed production for Canada was reduced on the basis of updated government data by almost 1 million tons to 19 million tons and the EU left unchanged at just 16.8 million ton.

Soy production has also been cut in Canada, leading to lower exports for 2020/21. Global ending soybean stocks for 2020/21 will decrease slightly by 1.3 million tons to 95.1 million, although lower stocks in Brazil and China will be partially offset by higher U.S. stocks.

For Brazil, the previous harvest in 2019/20 was increased by 2 million tons to 126 million and exports also increased. The new Brazilian harvest is expected to reach 131 million tons. China’s 2019/20 balance sheet changes include an increase in consumption of 2 million tons and imports of 96 million tons.

Soybean production in the United States is forecast to reach 112.5 million tons, which is an increase of 0.3 million tons due to the slightly larger harvest area.

This article is written on the behalf of Folio3 Animal Care Practice which is one of food safety software company in all over world